TVB Broadcast Members: when logged in, study decks will display for download. Create a TVB member account | Request forgotten password

The 2025 Media Comparisons Study, conducted by GfK/NIQ and commissioned by TVB, continues to be a key industry resource for multimedia usage and effectiveness. This comprehensive study examines over 20 platforms in traditional and digital media, including free and paid ad-supported and advertising-free streaming platforms.

For the first time, we measured the viewing of linear broadcast programs on digital devices and were therefore able to get a complete picture of broadcast’s assets: linear viewing on TV and mobile devices, as well as broadcast websites and apps. In addition to reach and time spent, the study looks at what the top and most trustworthy news sources are, as well as the level of community involvement and motivation to do further research online.

These findings are also broken down by demographics, ethnicity, and product category. The 2025 Media Comparisons Study once again confirms the power of television and continues to highlight broadcast TV as the top medium for both viewers and consumers, not only on a TV set, but across all devices.

Some key findings

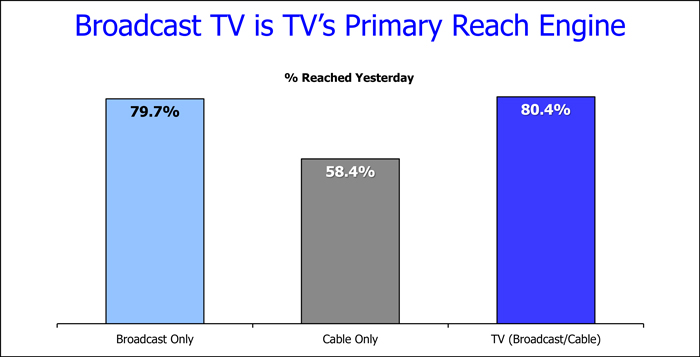

- TV has the highest reach and time spent of all media platforms studied, for all age groups and categories measured.

- Most TV viewers are reached through broadcast TV.

- Broadcast websites & broadcast TV on a digital device added more reach to broadcast TV than cable.

- Local Broadcast TV is turned to most for local news and is the most trusted.

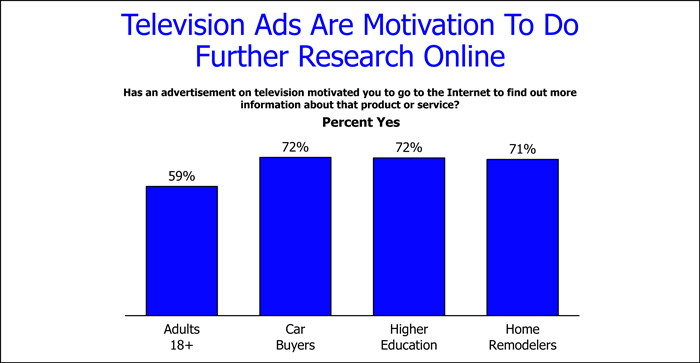

- Television ads are motivation to do further research online.

- More time is spent with broadcast TV across all devices than with cable and streaming programs.

- Broadcast digital assets alone reach between 34% to nearly half of respondents depending on segment/category.

- Total broadcast assets can reach 90% of key segments & categories.

- 43% cite local broadcast television assets as most involved in their community.

- 83% of the time spent viewing TV & movie programming is done on the TV Set.

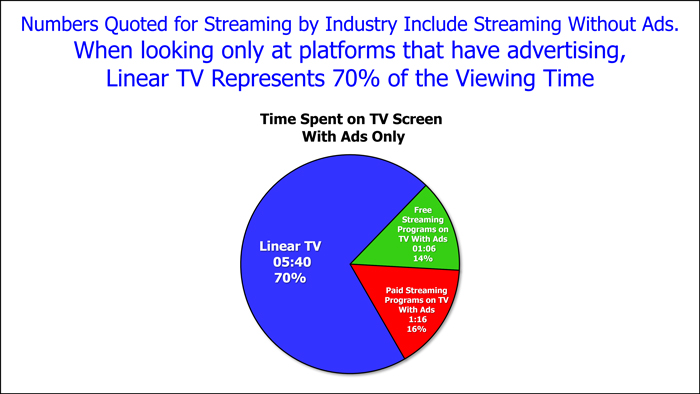

- Numbers quoted for streaming by the industry include streaming without ads.

When looking only at platforms that have advertising, linear TV represents 70% of the viewing time. - If they watch streaming on a TV set, they are reached by Broadcast as well.

QO3 – Has an advertisement on television motivated you to go to the Internet to find out more information about that product or service?

For more information, please contact Hadassa Gerber, Chief Research Officer, TVB.

© 2025 Television Bureau of Advertising, Inc. All rights reserved. Republication and redistribution of this report in total, other than by TVB members or its authorized agents or designees, without written permission is strictly forbidden. Any republication, in whole or in part, must include credit to TVB and its sources.