TVB Broadcast Members: PowerPoint with additional content available when logged in. To Request Login: Create a TVB member account | Request forgotten password

Download Overview PDF

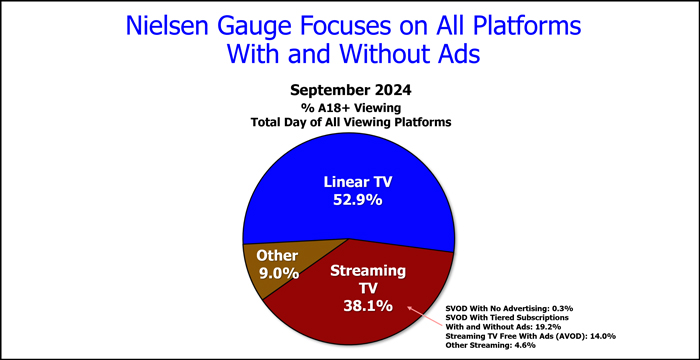

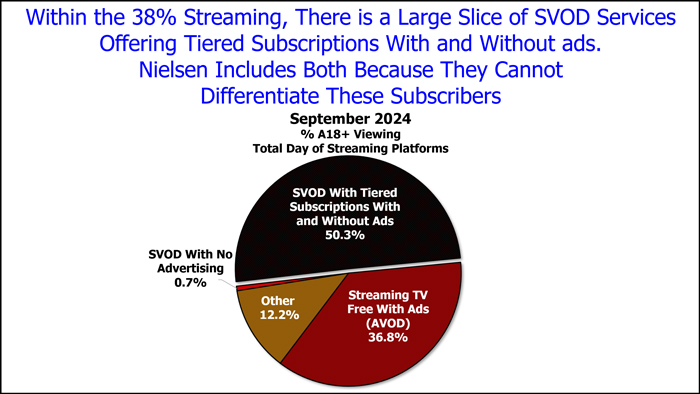

There continues to be much discussion of streaming’s share of total viewing, however, there is still far less discussion about the share of total viewing that has advertising. Advertisers cannot reach many of these streaming viewers because some platforms, such as Apple TV+, are advertising-free. Other streaming platforms, such as Hulu, Max (formerly HBO Max), and now Netflix, Disney+, and Amazon Prime Video offer tiered subscriptions, and the viewer may or may not see ads depending on which tier they pay for.

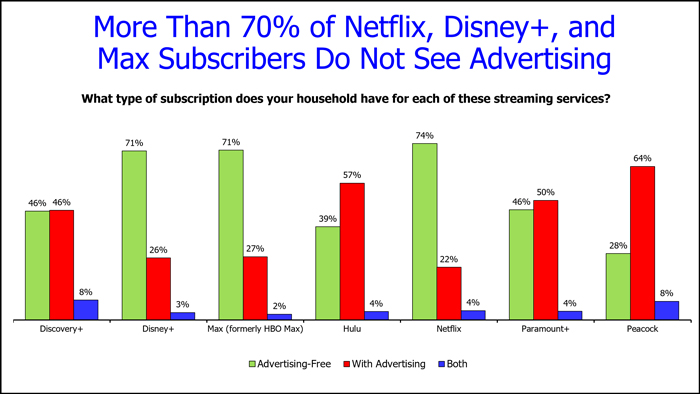

In fact, in August 2023, the TVB issued a press release on the results of Nielsen’s Gauge report: “The Gauge Report provides a monthly view of the content and programming that audiences are watching on a television screen, including broadcast, cable and streaming platforms. However, The Gauge does not provide the key data needed by advertisers. Specifically, The Gauge’s streaming numbers include ALL SVOD subscribers – those who do and don’t receive ads – and for most SVOD platforms subscribers viewing ads are a far smaller segment of the overall total viewing,” said Steve Lanzano, TVB President and CEO. According to the 2023 SVOD Study, a brand-new 4,000-respondent survey implemented by the well-regarded research company GfK and commissioned by TVB, more than 70% of Netflix, Disney+, and Max subscribers do not see advertising. In the press release, Lanzano continued, “So, while streaming TV viewing is prevalent, an overwhelming majority of SVOD streaming viewers don’t see commercials. Advertisers need these facts when considering streaming media investments.”

TVB continues to analyze linear and streaming viewing using Nielsen’s total use of television and streaming platform ratings, and the results showcase the value linear TV represents to advertisers.

The following key points highlight the strength of linear television to advertisers

- For February 2024, when looking at the Adults 18+ total viewing day (The Gauge report Nielsen continues to share is for people 2+), linear television represents 55% of viewing, compared to streaming TV’s 42%.

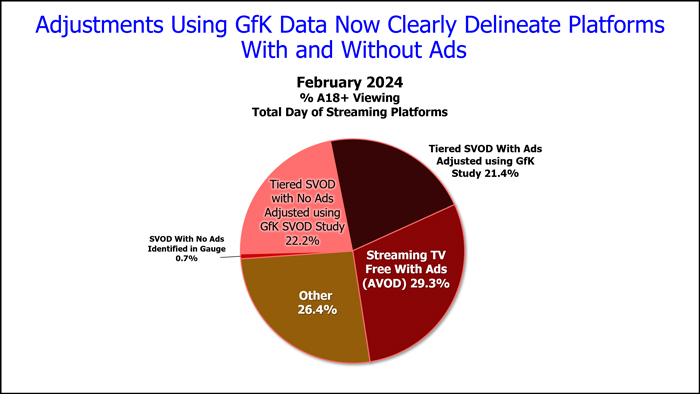

- Streaming viewing may be 42% of the total viewing day, but that does not translate to ad-supported viewing. Many SVOD platforms have different tiers, some with ads and some without; Nielsen shows one number for these platforms e.g., Hulu total viewing, versus Hulu with ads and Hulu without ads. As a result, advertisers do not know the number of subscribers viewing ads available to them.

- Recognizing this, the TVB commissioned GfK to do the 2023 SVOD Study to examine and better understand the streaming networks that people pay to get like Netflix, Amazon, Disney+, Max, Hulu, Paramount+, Peacock, etc.

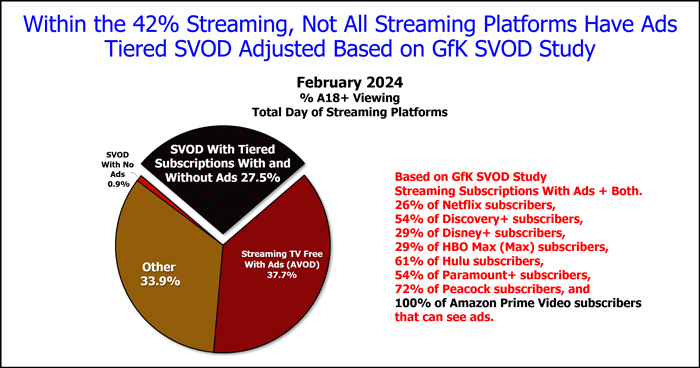

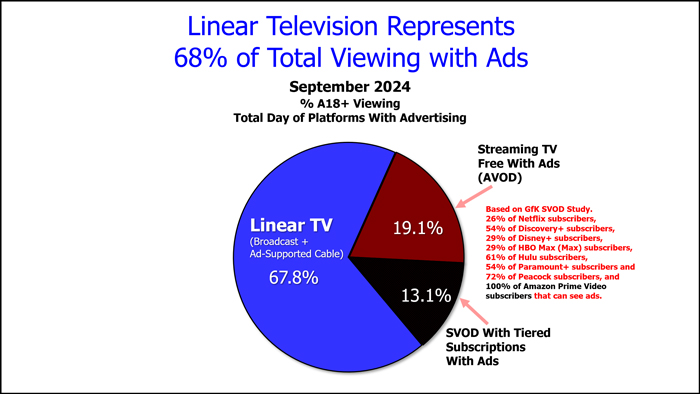

- The study showed that given a choice, more adult 18+ subscribers that are already paying for a subscription will pay more to get programming without ads on tiered SVOD platforms. Only 26% of Netflix subscribers (including multi-TV set households where 4% subscribe to both ad-supported and ad-free tiers), 54% of Discovery+ subscribers (including 8% that have both), 29% of Disney+ subscribers (including 3% that have both), 29% of Max subscribers (including 2% that have both), 61% of Hulu subscribers (including 4% that have both), 54% of Paramount+ subscribers (including 4% that have both), and 72% of Peacock subscribers (including 8% that have both), subscribe to an advertising tier. Additionally, on January 29th, 2024, Amazon Prime Video introduced “limited advertisements” in TV shows and movies running on their streaming platform. This was done for all customers unless they opted to pay an additional $2.99 per month to remain advertising-free. Since the 2023 GfK SVOD Study does not have any information on this new advertising tier for Prime Video, we were extremely conservative and assumed that 100% of Amazon Prime Video subscribers can see advertising.

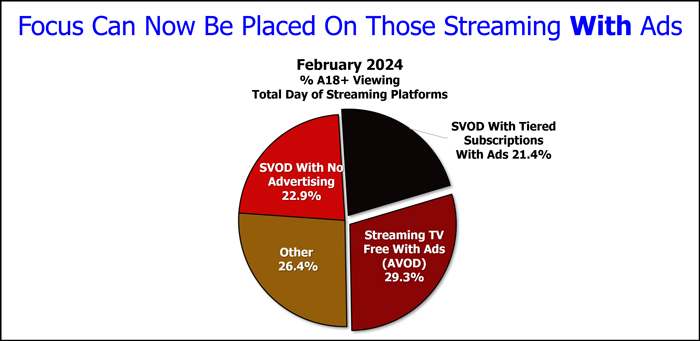

- In assembling a pie that dealt only with platforms that have advertising, we used those results from the 2023 GfK TVB SVOD Study to approximate ad viewing subscribers for those services. Using those percentages, we estimated those Netflix, Discovery+, Disney+, Max, Hulu, Paramount+, Peacock, and Amazon Prime Video subscribers that can see ads represent 21% of the total streaming pie, while 22% chose tiers with no advertising.

- Applying these assumptions, we developed a total viewing pie of platforms/tiers that have advertising, which included linear TV, AVOD and SVOD with tiered subscriptions. The result indicated linear TV represents 71% of total day of the ad-viewing platforms, a far cry from a pie including all viewing whether advertisers can avail themselves of it or not, showing linear TV at 55%. Advertisers need to know the platforms/subscribers available to them who can view advertising, so they can make informed marketing choices..

For more information, please contact Hadassa Gerber, Chief Research Officer, TVB.