TVB Broadcast Members: when logged in, the study deck will display below for download. Create a TVB member account | Request forgotten password

What Advertisers Really Need to Know About SVOD Viewership

It is no secret that streaming platforms have become a popular way to view content. However, there are questions about who is watching which services, whether these services have advertising, and whether these streaming viewers also view linear TV.

The 2023 SVOD study, a brand-new 4,000-respondent survey implemented by the well-regarded research company GfK and commissioned by TVB, attempts to better understand this vast world of streaming and how linear television, more specifically, local broadcast TV fits in it. Key findings from this study help advertising decision makers better understand the ad-supported media landscape and showcase the value linear TV continues to have for advertisers.

Some key findings:

- 95% of respondents have a TV in their home and the average number of TV sets per home is 2.6; 22% of all homes have 4+ TV sets.

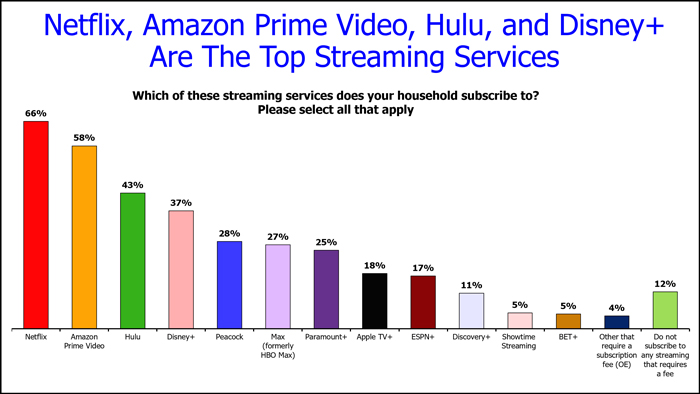

- Two-thirds of respondents subscribe to Netflix, while 58% subscribe to Amazon Prime Video.

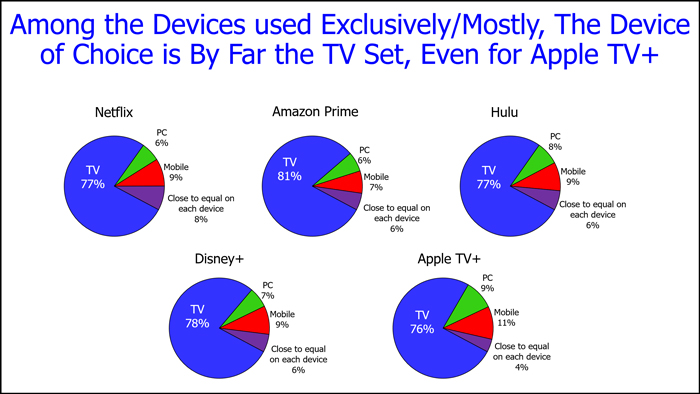

- When it comes to which device is used to stream and view content, the device of choice is the TV set, even for Apple TV+.

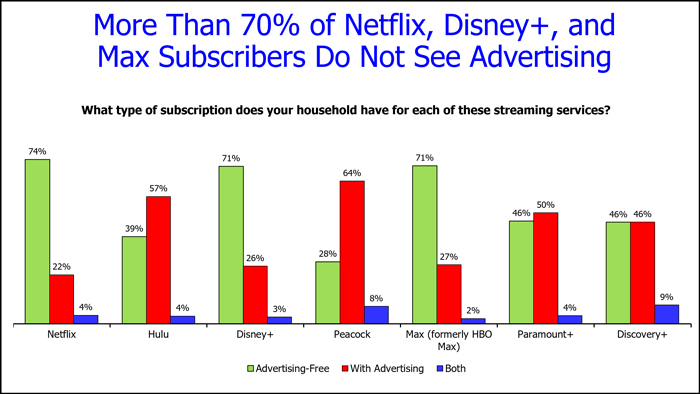

- 92% of respondents have at least one ad-free streaming service; only 8% exclusively have service(s) with ads.

- More than 70% of Netflix, Disney+, and Max subscribers do not see advertising.

- Local TV news is the most trusted news source. Local TV News websites/apps are the most trusted digital source. Social Media is the least trusted platform.

- 81% of respondents were exposed to local broadcast TV news either on a TV set or through an app/website.

- Broadcast TV and local TV news website/apps reach 88% of those who subscribe to SVOD with no ads.

- Younger adults tend to have more SVOD subscriptions than older adults and are more likely to have ad-free subscriptions.

- Hispanics and Black/African Americans have more TV sets than the average population and tend to have more SVOD subscriptions.

- Hispanics are more likely to have ad-free streaming subscriptions.

For more information, please contact Hadassa Gerber, Chief Research Officer, TVB